Let's claim you market your car to pay off some financial obligation (cheaper). You prepare to make use of ride sharing as well as public transportation momentarily, and also you're conserving approximately pay cash money for a cars and truck following year. It can be a good idea to obtain non-owner car insurance in the meantime to avoid paying higher premiums when you acquire that nice, debt-free automobile later.

And also as much as we would certainly love to give you a particular solution simply for your circumstance, we can't. (We understand, we understand (cheaper auto insurance).) The genuine solution is it depends. There are a great deal of variables that can influence the cost for non-owner car insurance coverage, like your previous driving document and how high your deductible is (or if you also have one).

Buying automobile insurance when you don't own an auto could not appear like one of the most simple point to do, but selecting to abandon insurance policy can present major dangers both when traveling as well as when you wish to obtain insurance coverage later. This is when non-owner cars and truck insurance coverage comes right into play. Non-owner cars and truck insurance is one way to see to it you're fulfilling your state's requirements for insurance coverage, and also it generally sets you back less than the coverage you would certainly acquire while having an automobile.

If your pal has a $30,000 home damages obligation restriction, you'll be on the hook for the continuing to be $20,000. If you have a $25,000 non-owner car insurance coverage policy, your insurance provider will certainly cover the rest of the damages – vehicle insurance. Damage to your good friend's vehicle would not be covered by a non-owner plan.

What Does A Non-Owner Cars And Truck Insurance Policy Policy Cover? It gives coverage for bodily injuries and also property damages for various other parties involved in a mishap you trigger.

Non-Owner Auto Insurance Cost Prices for non-owner car insurance coverage are generally less than common insurance policy costs, as the insurance coverage is so simplistic (car insurance). Nevertheless, there is no basic price for this type of auto insurance. As with any type of common policy, insurance firms will base the cost of non-owner automobile insurance coverage on a number of tailored factors, including your driving record, credit history, location, age, as well as extra.

Our How Is Allstate's Non-owner Car Insurance? [Our Review] PDFs

If you remain in this circumstance, you will pay significantly much more for your protection, as insurance providers will see you as a high-risk vehicle driver. You can start getting cost-free quotes for non-owner automobile insurance coverage by entering your zip code below. When Do You Need Non-Owner Automobile Insurance Policy? While you don't require auto insurance if you don't very own or regularly make use of a car, there are several circumstances in which it may be worth obtaining non-owner cars and truck insurance coverage.

Some states call for insurance to get or renew a chauffeur's license under what are frequently called "evidence of economic obligation" legislations (auto). Examine your state DMV's requirements wherefore it requires to get a certificate. Non-owner insurance coverage can be excellent if you're without a vehicle however are preparing on acquiring one soon.

cheaper auto insurance cheap car insurance cars

cheaper auto insurance cheap car insurance cars

Our Recommendations For Automobile Insurance coverage When it concerns getting cars and truck insurance, we advise putting in the time to contrast quotes from several business to find the finest protection for your spending plan. You can use the device listed below to secure free quotes from leading carriers in your location or read on to get more information about 2 of our highest-rated insurance companies.

If you do not own a lorry but are required to submit an SR22, you will certainly require to speak to an insurance coverage representative to buy a non-owner automobile insurance coverage plan. They can even digitally total as well as submit the required SR22 types for you, where allowed.

cheapest car insurance automobile auto cheapest auto insurance

cheapest car insurance automobile auto cheapest auto insurance

Make sure that you understand your state's SR22 regulations, in addition to any type of added requirements mandated by the courts and/or DMV in your location (cheaper cars). While it may appear strange to lug a car insurance coverage when you don't have a vehicle, a non-owner auto insurance policy covers vehicles you could drive momentarily, such as when obtaining a car from a close friend.

insurance cheap car insurance cheap car insurance insure

insurance cheap car insurance cheap car insurance insure

The insurance policy service provider usually bills a tiny fee for submitting the SR22 forms (normally varying from $15-25). Non-owner car insurance coverage prices differ by state, but because those with a history of website traffic and/or DUI offenses are thought about high-risk, lugging the SR22 will generally set you back even more than a normal non-owner automobile insurance coverage plan.

The 9-Second Trick For Do You Need Insurance If You Have A License But No Car?

At Breathe Easy Insurance coverage, we can aid you locate the very best possible rates on non-owner auto insurance policy to save you the optimum quantity of money. For a complimentary quote on non-owner insurance coverage as well as SR22 from here Breathe Easy Insurance policy, request a quote online or call us today at 833 (vehicle). 786.0237.

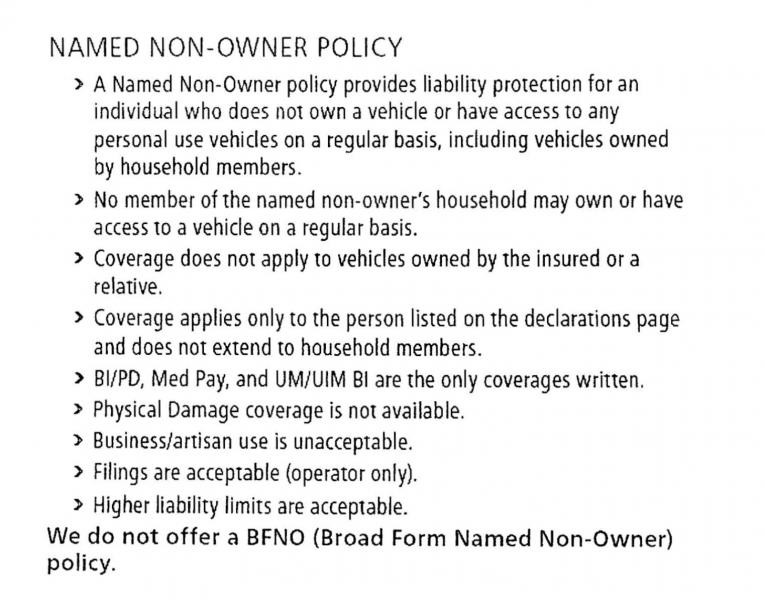

Updated April 19, 2022 What is Non-Owner Vehicle Insurance? is for those that frequently find themselves behind the wheel but do not possess an auto. car insurance coverage complies with the car, yet when it comes to non-owner cars and truck insurance, the insurance follows the motorist. Because the insured does not have a vehicle, there is no requirement for other protections, such as detailed or crash.

Nevertheless, their responsibility insurance policy coverage might be restricted depending upon what insurance coverage they selected. This implies that if you trigger an accident where somebody is seriously injured as well as do not have adequate responsibility insurance coverage to foot the prices, you might be directly in charge of their medical costs or automobile fixings – cheaper.

If you have no economic passion in a lorry, it's difficult for insurance coverage companies to rely on that you'll be encouraged to take care of that lorry. If you are in a state where this is not illegal, you may be able to obtain insurance coverage on an automobile you do not very own by including the proprietor of the auto to your insurance coverage policy.

Taking out a non-owner automobile insurance coverage policy is going to be your best wager. Who Should Think About a Non-Owner Automobile Insurance Plan?

That claimed, not everybody requires a non-owner vehicle insurance policy. Right here's a fast look at (5) individuals that could be a good suitable for non-owner auto insurance policy (vehicle insurance). 1. Vehicle Drivers Who Frequently Lease Automobiles or Usage Car-Sharing Solutions A lot of states do call for car insurance policy business to offer some kind of responsibility insurance with every cars and truck service.

The Buzz on Non-owner Car Insurance In Massachusetts

affordable car insurance insurance business insurance car insured

affordable car insurance insurance business insurance car insured

Chauffeurs That Borrow Autos Often Obtaining a cars and truck from an enjoyed one can be a wonderful way to avoid spending lavishly on your own automobile. That said, you're at the grace of their insurance coverage plan.

When you have your own policy, you'll reach pick your exact coverage limitations in addition to the business you take care of. 3 – cheap. Drivers That Had Their License Revoked, Required to File an SR-22 as well as Do Not Had a Vehicle An SR-22 is not a type of insurance coverage; rather, it's just a form saying that you have insurance coverage.

Your insurer will instantly send this kind to your state's department of automobile as soon as you have a policy. Normally, you'll need to file an non-owner SR-22 automobile insurance policy for three years after your initial court order. This is very easy enough to determine if you have a car and get an insurance coverage plan on it (auto insurance).

4. Motorists Who Marketed Their Car but Need to Avoid an Insurance Policy Insurance coverage Gap A chauffeur that does not have insurance for an extensive period might have problem acquiring insurance coverage again or wind-up paying much greater rates in the future. An insurance provider could wonder about why there was such a large gap in between plans, particularly considering that it's legitimately needed in all states to preserve vehicle insurance policy on your vehicles